Net present value (NPV) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. See full description at Wikipedia.

Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore

Where

t – the time of the cash flow

N – the total time of the project

r – the discount rate (the rate of return that could be earned on an investment in the financial markets with similar risk)

Ct – the net cash flow (the amount of cash) at time t

Interactive NPV Calculation – Click here to launch NPV chart

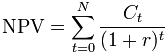

The following dashboard allows you to change the discount rate and see the time value of a dollar over a period of 5 years.

At a 10% discount rate a dollar in year 5 is worth 62 cents in today’s money

At a 50% discount rate a dollar in year 5 is worth 13 cents in today’s money

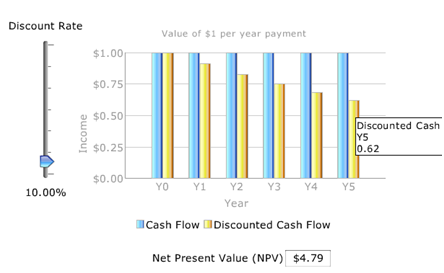

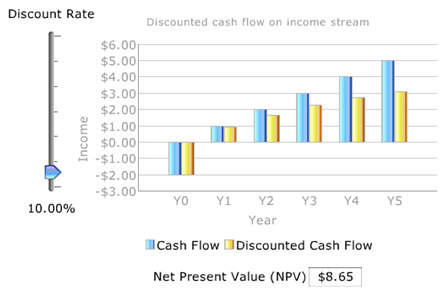

We can also demonstrate an arbitrary project with an initial cash outlay and an increasing yearly income stream

At a higher discount rate of 50% the future income is heavily discounted and the overall project NPV is significantly reduced.

Leave a comment